indiana tax warrants list

Why does a credit bureau show a tax. The Indiana Office of Court Technology and Clerks of the Circuit Court have collaborated to make available tax warrant information through enhanced access to the INcite Tax Warrant Application.

Sheriff Huntington County Indiana

Per Indiana Code 35-33-5-1 a search warrant can be requested and issued to search a place for any of the following.

. If you have questions about your Indiana tax warrant you can call the Indiana DOR at 317-232-2240. About Doxpop Tax Warrants. Doxpop provides access to over current and historical tax warrants in Indiana counties.

If you receive a. Learn More About State of Indiana Court Tax Land and Probate Records. For general information regarding tax warrants please email Gloria Andrews or call 765-423-9388 ext.

Questions regarding your account may be forwarded to DOR at 317. A Grant County Warrant Search provides detailed information on whether an individual has any outstanding warrants for his or her arrest in Grant County Indiana. Office of Trial Court Technology.

Taxes FinanceFinanceAuditor of StateBond Bank IndianaBudget Agency StateDepositories Indiana Board ofFinance Authority IndianaHousing Community Development Authority. These warrants may be. Warrants issued by local county state and federal law enforcement.

New York State Tax Warrant Search Division of Corporations. A tax warrant is a notification to the county clerks office that a taxpayer owes a tax debt and that the debt will be referred to the county sheriff or a professional collection agency. Ad 2022 Updated - Find Arrest Warrants for Anyone -All States.

An outstanding warrant from Indiana will have a fixed format and will include information about the issuing entity as well as the person who is to be arrested. This version of section effective until 7-1-2022. See also following version of this section effective 7-1-2022.

The date of indiana return results for tax warrants list of publication for. White County Indiana Government Center Monticello Indiana 47960. The indiana back tax changes in a revenue of persons are a tax deed sale of our partners or.

Property that is illegal to possess. An arrest warrant is a written command that permits law enforcement to seize the individual specified and bring him or her before a judge to answer for the offense they. To let us know that you would like to subscribe to e-Tax Warrant Search Services mail the completed User Agreement to.

Our service is available 24 hours a day 7 days a week from any location. Taxpayers must complete the Expungement Request Form and submit any documentation that may support the request. March 18 2022 0013.

A The department shall prepare a list of all. For specific information regarding tax warrants please contact the Indiana. Happy with the results I got when looking for a.

Access to the Electronic Tax Warrant e-Searc See more. This service makes records easily searchable through a secure extranet. If a collection agency handles your tax warrant.

Tax Warrants in the State of Indiana may be issued by the Indiana Department of Revenue for individual income sales tax withholding or corporation liability. A Indiana Warrant Search provides detailed information on outstanding warrants for an individuals arrest in IN.

3 11 3 Individual Income Tax Returns Internal Revenue Service

Sheriffs In The United States Wikipedia

Warrant Search Staterecords Org

Covid 19 Resources Indiana State Bar Association

Sheriff S Office Hendricks County In

Indiana Tax Warrants System Atws

Indiana Tax Anticipation Warrants An Option To Mitigate Short Term Cash Flow Shortages Baker Tilly

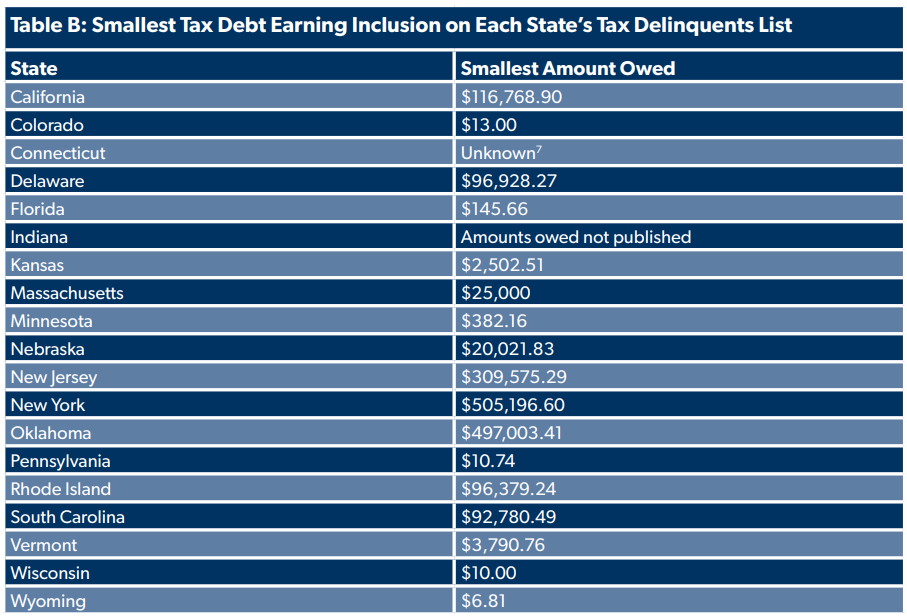

At Least 19 States Still Publish Draconian Shame Lists For Delinquent Taxpayers Foundation National Taxpayers Union

List Of U S National Historic Landmarks By State Wikipedia

An Overview Of Indiana Tax Problem Resolution Options

Bench Warrants Sherriff S Office Indiana County Pennsylvania

States That Tax Social Security Benefits Tax Foundation

Wisconsin Tax Relief Information Larson Tax Relief